Shop Around

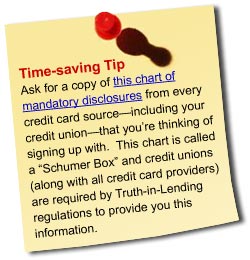

Not all credit cards are equal, so shop around and compare what’s out there before you apply for any credit card.

Compare these features:

Annual Percentage Rate (APR) – APR, a measure of the cost of credit, is expressed as a yearly interest rate. The credit card issuer must disclose this information to you before you become obligated on the account; this rate must also appear on your account statements.

Periodic Rate – The periodic rate is the rate the credit card issuer applies to your outstanding balance to figure the finance charge for each billing period. The card issuer must disclose this information.

Periodic Rate – The periodic rate is the rate the credit card issuer applies to your outstanding balance to figure the finance charge for each billing period. The card issuer must disclose this information.

Grace Period (Free Period) – The grace period is the time between the date of a purchase and the date interest starts being charged on that purchase (usually the account’s due date). A grace period lets you avoid finance charges by paying your balance in full before the due date. If your card does have a grace period, then the issuer must mail your bill at least 14 days before the due date so you’ll have enough time to pay. (If an issuer charges interest from either the date you use your card or the date each transaction is posted to your account, then there is no grace period.)

Annual Fees – Some credit card issuers charge an annual fee for granting you credit, but other issuers do not.

Transaction Fees and Other Charges – Some credit card issuers charge a monthly flat fee—whether you use the card or not. Other credit card issuers charge a fee if you use your card to get a cash advance, pay your bill late, or exceed your credit limit.

Customer Service – Is there a toll-free, 24-hour telephone number to call for assistance? This is especially helpful if you have question about your account or your card is either lost or stolen.

Other Benefits – Some credit card issuers offer additional benefits, but watch out! Often there is a charge for those benefits. Benefits that might be offered include insurance, discounts, rebates, and credit card protection.

Other Features – Is the credit limit high enough? (Remember, you don’t need to charge up to your limit!) Is the card widely accepted? If not, then it’s probably not your best choice.

Bottom line: It’s the law. You must be told the Annual Percentage Rate—and much more—of any credit card you’re thinking of applying for.